Last Updated on November 21, 2024 by Carlos Alonso

As the end of the year approaches, small business owners are exploring strategies to reduce their tax burden while preparing for a strong start in the upcoming year. One effective yet often overlooked approach is prepaying for marketing expenses.

By paying now for next year’s services, businesses can lower their taxable income for the current year, lock in current pricing, and ensure they’re set up for success when the new year begins under the cash basis method of accounting. To take full advantage of this strategy, it’s important to understand how the IRS’s 12-Month Rule applies to prepaid expenses.

Let’s dive into what the rule entails, practical examples of how it works, and how prepaying for marketing with Catdi Printing can benefit your business.

What is the IRS 12-Month Rule?

The 12-Month Rule is a tax guideline from the IRS that allows businesses to deduct prepaid expenses in the year they are paid if the benefit period meets two key criteria for cash basis taxpayers:

- The benefit period is crucial for determining tax deductions. 12 months or less, AND

- The benefit period does not extend beyond the end of the next tax year.

For example, if you prepay for marketing services in December 2024 and those services are delivered by December 2025, you can deduct the entire amount on your 2023 tax return. However, if the benefit period extends beyond December 2025, only the portion used within the eligible period can be deducted.

Why Prepaying Marketing Expenses Makes Sense

Prepaying marketing expenses isn’t just about tax savings—it’s a forward-thinking strategy that helps businesses plan for the future while optimizing their current financial situation.

Lower Your Taxable Income

Reducing your taxable income is the most immediate benefit of prepaying marketing expenses. By deducting these expenses in the current year, you can significantly lower your tax liability, especially if your business has had a profitable year.

Lock in Current Rates

Inflation and rising costs can eat into your marketing budget. Prepaying allows you to secure today’s prices for services you know you’ll need, protecting your budget from potential price increases in the new year. Future postage rates would be the only variable in prepaid marketing services as it tends to go up.

Prepare for Success

Starting the new year with prepaid marketing services ensures you’re ready to hit the ground running. No scrambling for resources or last-minute planning—your campaigns are primed to launch when you need them.

Utilize Remaining Budget Wisely

If you have unspent funds in your current year’s budget, prepaying for marketing is a smart way to allocate those resources now. Rather than leaving money unused, you can invest it in services that drive growth in the months ahead.

Marketing Services You Can Prepay for with Catdi Printing

Catdi Printing offers a wide range of marketing services that qualify under the 12-Month Rule, allowing you to reduce taxes and prepare for success.

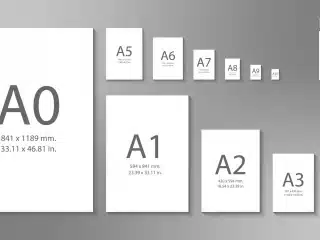

- Direct Mail Campaigns: Prepay for mailing lists, design, printing, and postage to execute targeted or Every Door Direct Mail (EDDM) campaigns in the coming year.

- Print Collateral: Secure essential materials like business cards, brochures, postcards, and flyers to keep your branding consistent and professional.

- Website Design and Updates: Invest in a refreshed website or enhanced features to boost your online presence and user experience.

- Graphic Design Services: Lock in hours for creating custom promotional materials such as logos, ads, and flyers.

- Large-Format Printing: Prepay for banners, trade show displays, and signage for events or storefront promotions.

Real-World Examples of the 12-Month Rule

To better understand how the 12-Month Rule applies to marketing expenses, here are some practical scenarios for cash basis taxpayers:

- A company prepays in December 2023 for a direct mail campaign scheduled for January through March 2024. Since the benefit period is less than 12 months and ends within the next tax year, the entire expense is deductible in 2023.

- A business invests in a website redesign in December 2023, with completion expected by June 2024. The full cost qualifies for deduction on the 2023 tax return because the service period falls within the rule’s criteria.

- A company prepays for 5,000 brochures in December 2023 to be distributed throughout 2024. The cost is deductible because the benefit period remains within the next tax year.

- A business signs a two-year advertising contract in December 2024. Only the portion covering services from January to December 2025 is deductible in 2024, with the remainder deducted in subsequent years.

Benefits of Prepaying Marketing Expenses

Immediate Tax Savings

Prepaid marketing expenses reduce taxable income for the current year, lowering the overall tax burden. This is especially beneficial for businesses experiencing higher-than-usual profits.

Simplified Budgeting

Prepaying ensures predictable costs for key marketing services, helping you avoid budget surprises in the new year.

Focused Campaign Planning

With prepayments secured, businesses can focus on strategy and execution rather than financial logistics, ensuring campaigns are impactful and timely.

Enhanced ROI

By locking in services and rates, you can maximize your return on investment (ROI) while avoiding potential price increases.

Tips for Maximizing Prepaid Marketing Tax Benefits

- Document All Business Expenses: Maintain detailed invoices and receipts to provide to your tax professional. Proper documentation ensures compliance with IRS guidelines.

- Consult a Tax Advisor: Work with a CPA to confirm which expenses qualify under the 12-Month Rule and how to maximize deductions.

- Plan Strategically: Focus on services that align with your marketing goals and will be used within the qualifying period.

- Bundle Services for Savings: Catdi Printing offers bundled packages for direct mail, graphic design, and print collateral, allowing you to save money while securing multiple services.

Why Choose Catdi Printing?

Catdi Printing makes prepaying for marketing services simple, transparent, and effective.

- Custom Packages: Tailored to your business needs, combining direct mail, print collateral, website updates, and more.

- IRS Compliance: We provide detailed and transparent records to ensure your prepayments meet IRS requirements.

- Comprehensive Solutions: From print to digital marketing, we’re your one-stop shop for everything your business needs to thrive.

- Expert Guidance: Our team works closely with you to create a marketing strategy that aligns with your goals while maximizing tax savings.

Prepaying for marketing expenses isn’t just a smart tax-saving strategy—it’s an investment in your business’s future. By leveraging the IRS’s 12-Month Rule and focusing on eligible business expenses, you can lower your tax burden while setting yourself up for a successful new year.

Whether you’re planning direct mail campaigns, refreshing your website, or investing in print collateral, Catdi Printing offers the services and expertise you need. Contact us today to learn more about our prepaid marketing packages and discover how we can help your business save on taxes while preparing for growth in 2025!

Disclaimer

This article is intended for informational purposes only and does not constitute financial, legal, or tax advice. IRS regulations, including the 12-Month Rule, may vary depending on your individual circumstances. Before making financial decisions, consult a qualified tax professional or CPA to ensure compliance and maximize your tax savings.